Numpy

Overview

Teaching: 45 min

Exercises: 15 minQuestions

What is Numpy and how do I use it?

Objectives

Create a numpy array

Working with numpy array (slicing)

Working with numpy axis ( np.sum(axis=0) vs np.sum(axis=1) )

Tie in Numpy to Pandas (Pandas is a wrapper to Numpy)

Do Numpy math on Pandas DataFrame ( np.sqrt(df) , np.sin(df) )

Verify Install

Verify numpy is installed

(python102) $ conda list | grep 'numpy'

numpy 1.13.3

Note: This module assumes you are using anaconda3. Anaconda has it’s own package manager called conda. For standard python use pip. ex:

(python102) $ pip freeze | grep 'numpy'

numpy==1.13.3

If numpy is not installed, install it with conda:

(python102) $ conda install numpy

If you are using standard python and numpy is not installed, install it with pip:

(python102) $ pip install numpy

NumPy Arrays

NumPy is the fundamental package for scientific computing with Python. NumPy’s main object is a homogeneous multi-dimensional array. NumPy’s array class is called ndarray. NumPy’s array class differs from standard Python’s array class in that a standard Python array is only one dimensional.

Create a two dimensional array with:

import numpy as np

a = np.array([[0,1,2,3],[4,5,6,7]])

The basic NumPy functions are:

numpy.shape: returns a tuple with one integer for each dimension. Each integer represents the length of that dimension.

numpy.size: returns the total number of elements in the array. ie the product of the dimensions returned by np.shape()

numpy.dtype: returns the datatype of the elements

print(a.shape)

print(a.size)

print(a.dtype)

To create a range of numbers numpy provides the arange function similar to python’s range

print(np.arange(0,100,1))

print(np.arange(0,30,.3))

Numpy also provides linspace(X,Y,N) which creates an array of N evenly spaced numbers between X and Y

print(np.linspace(0,20,15))

Basic NumPy Operations

Arithmetic operations on NumPy arrays are elementwise:

x = np.ones((4,4))*3

y = np.linspace(0,3,16).reshape(4,4)

z = x-y

print(z)

NumPy provides the dot() function for the dot product

z = x.dot(y)

z = np.dot(x,y)

print(z)

NumPy also provides in place operators like += and *=

y += x

y -= x

z *= x

print(z)

NumPy has all the features of a good scientific calculater and then sum:

# sums all values of y

y.sum()

# sums all values along an axis

y.sum(axis=0)

y.sum(axis=1)

# cumulative sum along an axis

y.cumsum(axis=0)

y.cumsum(axis=1)

# elementwise square root

np.sqrt(y)

# sine function

np.sin(np.arange(0,2*np.pi,.1))

NumPy Financial Functions

NumPy includes it’s own set of basic financial functions as well:

# Compute the payment against loan principal plus interest

# What is the monthly payment needed to pay off a $200,000 loan in 15 years at an annual interest rate of 7.5%?

np.pmt(0.075/12, 12*15, 200000)

# Return the Internal Rate of Return (IRR).

# This is the “average” periodically compounded rate of return that gives a net present value of 0.0

np.irr([-100, 39, 59, 55, 20])

Economic example using NumPy

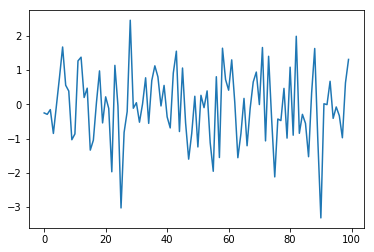

Random numbers are crucial in many simulations and models, including Monte Carlo simulations. NumPy provides a variety of random number generators including many of the most common distributions.

import matplotlib.pyplot as plt

x = np.random.randn(100)

plt.plot(x)

plt.show()

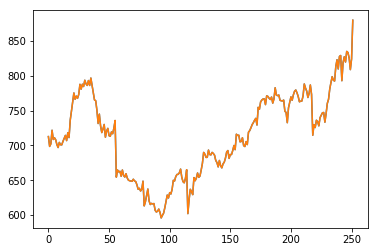

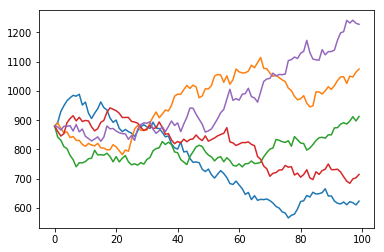

Let’s run through a Monte Carlo simulation predicting stock values for Autozone.

Download the following file into your data directory: AZO Adjusted Close

Load the file using np.loadtxt() and display it:

data = np.loadtxt('AZOadj.csv')

plt.plot(data)

plt.show()

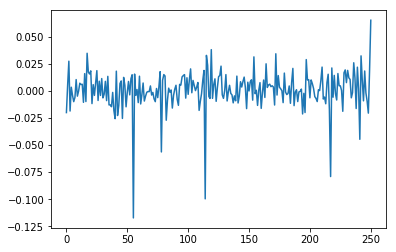

Calculate the log returns and plot them:

log_returns = np.diff(np.log(data))

plt.plot(log_returns)

plt.show()

Next calculate the mean (u), variance (var), Standard deviation (std) and drift (drift)

u = log_returns.mean()

var = log_returns.var()

std = log_returns.std()

drift = u-(0.5*var)

Say we want to run 5 simulations predicting the next 100 days of returns. First generate a 2 dimensional array of random values of size (100,5):

rand_vals = np.random.rand(100, 5)

print(rand_vals.shape)

(100, 5)

Next with some help from SciPy’s statistical library let’s calculate the percent point function using our random values:

from scipy.stats import norm

ppf = norm.ppf(rand_vals)

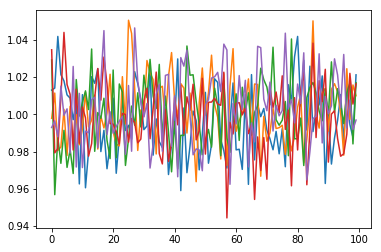

Calculate the daily returns using the results of our previous step and plot them:

returns = np.exp(drift + std*ppf)

plt.plot(returns)

plt.show()

Convert this back to daily stock values by creating an empty 2 dimensional array the same size as our returns and assign the first row (starting values) to be the same as the last row in our initial data set. Then loop through our data calculating the daily values and plot it

predictions = np.zeros(returns.shape)

predictions[0] = data[-1]

for i in range(1,predictions.shape[0]):

predictions[i] = predictions[i-1]*returns[i]

plt.plot(predictions)

plt.show()

Rerun the Simulation

Rerun the simulation several times to see how the results vary. Why do they vary?

Solution

# Load the data data = np.loadtxt('AZOadj.csv') # calculate the log returns log_returns = np.diff(np.log(data)) # calculate the mean, variance, standard deviation and drift u = log_returns.mean() var = log_returns.var() std = log_returns.std() drift = u-(0.5*var) # generate random series rand_vals = np.random.rand(100, 5) # calculate the percent point function from scipy.stats import norm ppf = norm.ppf(rand_vals) # Calculate daily the returns returns = np.exp(drift + std*ppf) # Convert this back to daily stock values and plot predictions = np.zeros(returns.shape) predictions[0] = data[-1] for i in range(1,predictions.shape[0]): predictions[i] = predictions[i-1]*returns[i] plt.plot(predictions) plt.show()

Different Distributions

Modify the simulation to use a different random distribution (NumPy.random)

Solution

# Load the data data = np.loadtxt('AZOadj.csv') # calculate the log returns log_returns = np.diff(np.log(data)) # calculate the mean, variance, standard deviation and drift u = log_returns.mean() var = log_returns.var() std = log_returns.std() drift = u-(0.5*var) # generate random series rand_vals = np.random.beta(a=2,b=1,size=(100, 5)) # calculate the percent point function from scipy.stats import norm ppf = norm.ppf(rand_vals) # Calculate daily the returns returns = np.exp(drift + std*ppf) # Convert this back to daily stock values and plot predictions = np.zeros(returns.shape) predictions[0] = data[-1] for i in range(1,predictions.shape[0]): predictions[i] = predictions[i-1]*returns[i] plt.plot(predictions) plt.show()

Key Points

Create and use a numpy array

Explore numpy features